How to Build a Dividend Portfolio for Beginners.

A dividend portfolio focuses on investing in companies that regularly (usually quarterly) distribute a portion of their profits to shareholders. This can provide a steady source of passive income.

1. Understand the Basics:

What are dividends? A portion of a company’s earnings that are distributed to its shareholders.

Why dividends? They provide income, can offer stability (mature companies often pay dividends), and can grow over time.

Dividend Yield: The annual dividend payment per share divided by the share price. A higher yield isn’t always better; sometimes, a very high yield indicates a struggling company.

2. Determine Your Goals:

Are you looking for income now or increased income over time?

What is your risk tolerance? Dividend stocks may still be undervalued.

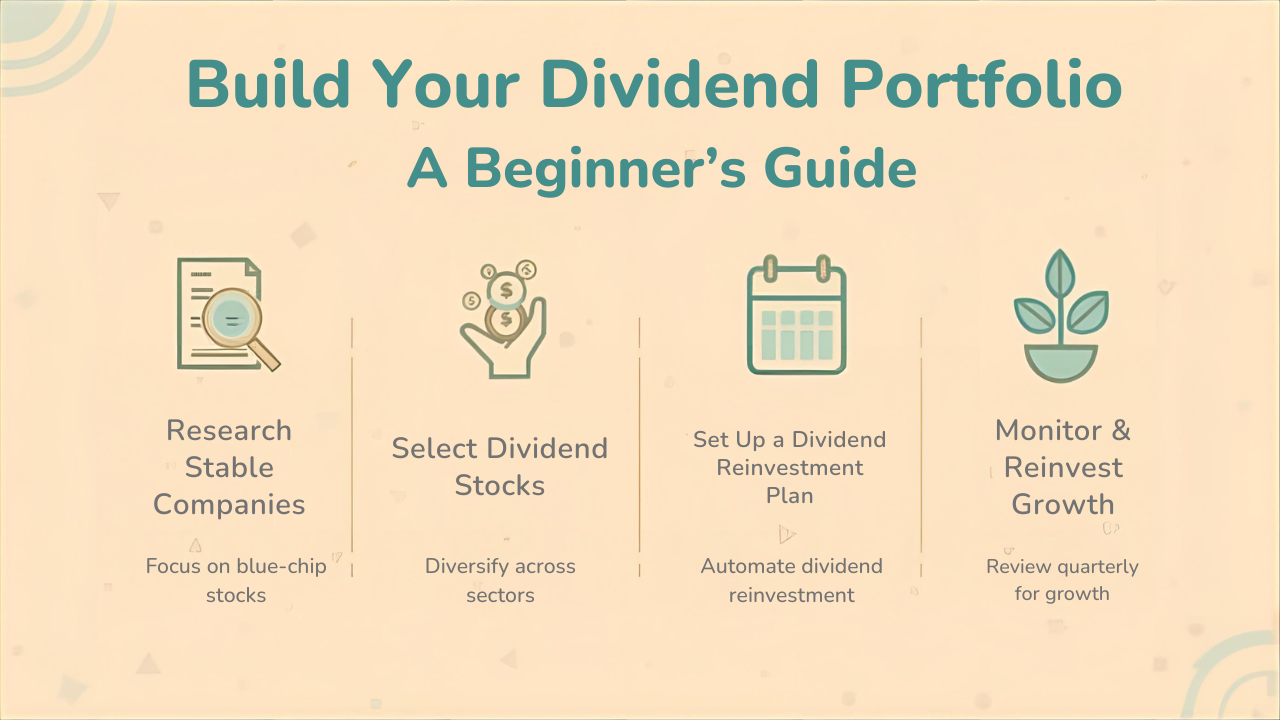

3. Research quality companies (instead of just high yields):

Stable businesses: Look for companies with a long history of profitability and consistent dividend payments. Think consumer goods, utilities, established technology, or healthcare.

Dividend history: Companies that have consistently paid and increased dividends for many years (Dividend Aristocrats/Kings are good examples) often indicate financial health.

Payout ratio: The percentage of earnings a company pays out as dividends. A ratio between 40-60% is generally considered healthy; too high may mean the dividend is unsustainable.

Debt level: Companies with manageable debt are better positioned to continue paying dividends.

4. Diversification:

Don’t put all your money in one or two dividend stocks. Spread your investments across different sectors and industries.

Consider dividend ETFs or mutual funds for instant diversification.

5. Start small and reinvest:

You don’t need a lot of capital to get started. Fractional shares can be purchased for as little as $50-$100 at some brokerages.

Dividend Reinvestment Plans (DRIPs): Many brokers offer DRIPs, which use your dividends to automatically buy more shares of the same stock. This is an effective way to increase your returns over time.

6. Choose a Brokerage:

Look for a brokerage with low or no commissions for stock trading. Popular options include Fidelity, Schwab, Vanguard, and M1 Finance (suitable for automatic dividend investing).

Example Stocks/ETFs (for research, not recommendations):

Individual Stocks: Coca-Cola (KO), Johnson & Johnson (JNJ), Procter & Gamble (PG), Verizon (VZ) – these are often mentioned for their long dividend histories.

Dividend ETFs: Vanguard Dividend Appreciation ETF (VIG), Schwab U.S. Dividend Equity ETF (SCHD), iShares Select Dividend ETF (DVY) – these offer diversification across many dividend-paying companies.

Challenge to Save $1,000 in 30 Days

Saving $1,000 in a month is ambitious, but it’s possible, especially if you’re dedicated. Here’s a plan:

1. Track Your Spending (Days 1-3):

For a few days, closely track every dollar you spend. This helps you see where your money is actually going. Apps like Mint, YNAB, or even a simple spreadsheet can help.

2. Create a “Sacrifice” Budget:

Identify non-essentials: Where can you cut back for 30 days?

Eating out/takeaway: Stop completely. Cook every meal at home.

Coffee/Drinks: Avoid Starbucks/cafes. Make coffee at home.

Entertainment: Cancel streaming for a month, don’t watch movies, or watch any paid programs. Use free options (library, park).

Shopping: Don’t buy new clothes, gadgets, or impulse buys.

Subscriptions: Review and temporarily suspend anything you don’t use daily.

3. Generate Extra Income (Proactive Steps):

Sell Unused Items: Go through your home. Clothes, electronics, books, furniture. List them on eBay, Facebook Marketplace, Craigslist, Poshmark. You’ll be surprised how quickly it adds up.

Miscellaneous Jobs: Offer services to neighbors or friends – pet sitting, babysitting, yard work, car washing, dog walking.

Freelance: If you have skills (writing, graphic design, tutoring), find some small work on Upwork or Fiverr.

Delivery/Gig Economy: Sign up for Uber Eats, DoorDash, Instacart, etc., and work a few extra hours.

4. Optimize Current Expenses:

Groceries: Plan meals carefully. Buy store-brand products. Focus on inexpensive ingredients (rice, beans, pasta, seasonal produce). Avoid food waste.

Transportation: Whenever possible, walk, cycle, or use public transportation instead of driving/ridesharing. Combine errands.

Utilities: Be extremely vigilant about turning off lights, adjusting the thermostat, and taking shorter showers.

5. Automate savings and stay accountable:

Set daily/weekly goals: To save $1,000 in 30 days, you’ll need to save about $33 per day. Divide it up.

Instant transfer: As soon as

Determine the required capital.

The most important component in your investment portfolio is the Dividend Yield, which is calculated as the annual dividend income divided by the initial investment amount and given as a percentage.

The formula for determining the required investment is:

In India, the typical dividend yield for solid, established corporations is often between 2% and 4%. Let us look at the capital necessary for different yield scenarios.

Investing Strategies

To achieve and sustain this goal, you must select appropriate investment vehicles:

A. Individual Dividend Stocks

Focus: Look for companies that have a lengthy history of paying and, ideally, rising dividends. A high yield alone can be a red flag if the company’s finances are poor.

Key Metrics to Check:

Dividend Yield: Aim for the highest sustainable yield.

Payout Ratio: The percentage of earnings distributed as dividends. A ratio of 30% to 60% is frequently considered healthy. Too high may not be sustainable.

Debt-to-Equity Ratio: A lower ratio typically indicates a financially solid organization.

Diversification: Don’t put all of your money into one or two high-yield stocks. Diversify into stable areas such as FMCG, IT, utilities, and oil and gas. (Popular Indian examples include companies such as ITC, Infosys, TCS, Coal India, NTPC, and others, however this is solely for illustrative purposes and does not constitute a recommendation to buy.)

Dividend-Yield Mutual Funds/ETFs offer the benefit of automatically investing in a diverse basket of high-dividend-paying stocks. This eliminates the danger of choosing specific stocks.

Strategy: You can either invest a lump sum or use a Systematic Investment Plan (SIP) to construct your portfolio over time.

Financial advisors often recommend investing in growth stock or debt mutual funds and employing a Systematic Withdrawal Plan (SWP) in retirement, as an alternative to dividends.

How it Works:

Withdraw a fixed amount (e.g., ₹8,333/month for ₹1 lakh/year) on a regular basis. This withdrawal is a combination of capital gains and principal, making it more tax-efficient than pure dividend income (depending on tax rules) and more trustworthy than genuine corporate dividend statements.